How to Build a Retirement Plan that Lasts

An Introduction to the Sure Horizon Retirement Income Strategy™

Getting Started

So you've been dreaming about retirement-lazy mornings with coffee, no more work deadlines, and maybe some travel to check off that bucket list. But let's face it-the "freedom" of retirement isn't free. It takes careful planning to make sure your financial nest egg doesn't run out before your travel bucket list does.

Building a retirement plan that lasts is like assembling IKEA furniture: it looks easy, but if you don't have all the right pieces (and follow the instructions), you'll end up with something wobbly and unstable. But don't worry - you won't need an Allen wrench for this one. With a little forethought and the right strategy, your retirement will be a sturdy, well-built masterpiece.

I will take you through step by step how we build plans for clients here at Sure Horizon Retirement Advisors. Plus I will share some of my favorite free tools with you along the way. Who doesn’t love free?

Assessing Your Current Financial Situation

Before we can build a retirement plan that lasts, we need to know what tools and materials we're working with.. In retirement planning, this means taking a good, hard look at your current financial situation.

Step 1: Your financial inventory

No matter where you are on your retirement journey, you need to take stock of what you already have. This isn't the time to dream about what you think you should have. We're talking about cold, hard numbers. You need to know:

- Your net worth: This is just a fancy way of saying "what you own minus what you owe." If the idea of calculating your net worth sounds like high school algebra, don't worry. It's easier than it sounds. You add up your assets (savings, investments, real estate) and subtract your liabilities (mortgage, debt). Boom. Net worth.

Need some help? Our Retirement Planning Toolkit includes a Net Worth Worksheet that makes this process a lot easier.

Step 2: Identify Your Income Sources

Next, you need to figure out where your money will come from in retirement. Spoiler alert: It won't come from your 9-to-5. We're talking about:

- Social Security: It's there, but will it be enough? Probably not, which is why it's important to know what your Social Security benefits will be and when you should file for them. .

- Pensions: If you're lucky enough to have one, congratulations! But not everyone has a golden ticket in the form of a pension.

- Investments & Savings: Whether it's a 401(k), an IRA, or your secret stash under the mattress, you need to know what's available and how to turn it into usable income.

Step 3: Understanding the Components of a Retirement Plan That Lasts

All right, now that we've dug through the financial garage and figured out what we have to work with, it's time to talk strategy.. The key to a winning retirement plan is making sure your money doesn't run out while you're still busy living your best life.

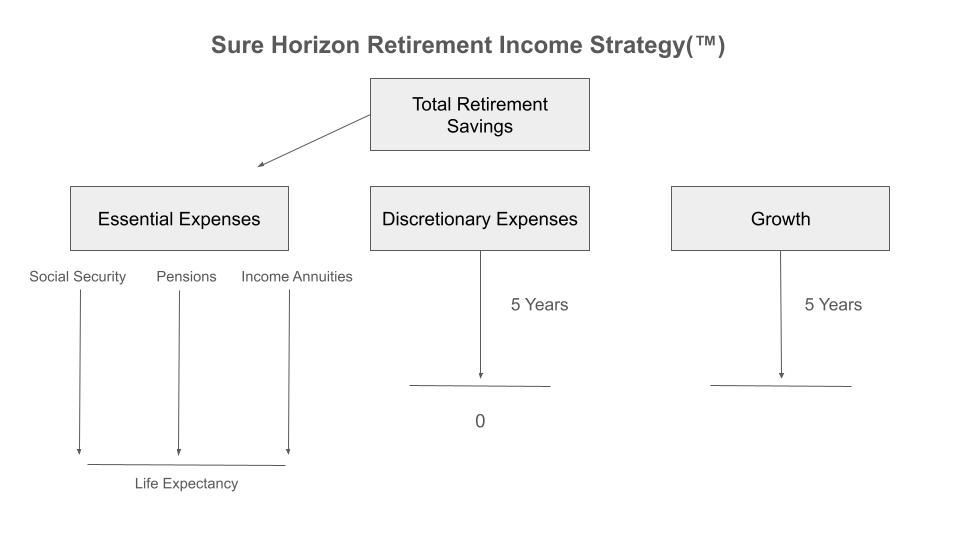

Enter: The Sure Horizon Retirement Income Strategy(™). Fancy name? Sure. I was taught the basics of this strategy early in my career and have gone on to add my own spin to it. But here's where the magic happens. We're talking about a strategy built on three major pillars:

Guarantees: The Safety Net.

First things first-you want to know you won't run out of money, right? That's where the guarantees come in. We're talking about things like Social Security, pensions (if you have one), and annuities. Think of these as your retirement safety net-the reliable income that will always be there, no matter what.

- Social Security: This is your monthly check from Uncle Sam. Sure, it won't make you rich, but it's a steady, reliable stream that will help cover some of your essential expenses.

- Pensions and annuities: If you're one of the lucky ones with a pension, treat it like gold. And if you don't have one? Don't panic. You can create your own "pension" with annuities, which basically turn your savings into a guaranteed paycheck for life.

Action Tip: If you're not sure how much guaranteed income you'll need, the

Retirement Planning Toolkit

has a handy worksheet to help you estimate your essential expenses and match them with guaranteed income sources. After all, no one wants to be playing Survivor: Retirement Edition when the money runs out. If you haven’t already done so, download a copy here. (Link)

Flexibility: The Joker

If life has taught us anything, it's that it's unpredictable. That's where flexibility comes in. You need to have some wiggle room in your retirement plan to cover the "extras"-you know, things like travel, hobbies, or unexpected expenses (hello, new roof).

- Bond Ladder: Typically for our clients, we build a 5 year bond ladder with one bond maturing each year (usually in January). Every 5 years we re-build this ladder from our Growth Pool and do it all over again.

- Dividend Paying Stocks: For most of our clients in or around retirement, we have build a high yielding/dividend paying portfolio. These stocks are typically in 3 major areas: Collateralized Loan Obligations (CLO’s), Business Development Corporations (BDCs) and Senior Loan Credit Funds. The common thread is that all of these throw of a majority of their income in the form of dividends. As a result they tend to be a nice stabilizing force in client portfolios that pays well.

- Part-time work or side hustles: You may want to keep working a little bit, either because you need the income or because you just like to stay busy. No shame in that

Case in point: Imagine you're cruising through retirement, but you decide to take a fancy vacation in Italy. Your guaranteed income will cover the basics, but the trip? That's coming out of your flexible income bucket. With a little careful planning, you can sip wine in Tuscany without worrying about paying the bills back home.

Growth: Keeping the Party Going

Finally, there's growth. Retirement isn't all about playing it safe - you need to keep some of your money growing, because inflation is a sneaky little thief that will erode your purchasing power if you're not careful. That means keeping a portion of your portfolio invested in growth assets like stocks. The good news with our strategy is that you now have 5 years to let these assets grow without needing them. Every year you can do this lessens your overall risk.

Stocks and real estate: Think of these as the long-term growth drivers in your plan. You don't need to go all-in on risky investments, but a little exposure to stocks and maybe even real estate can help your money keep up with inflation.

Protect against inflation:

If you don't grow your money, inflation will eat away at your savings. We're not saying you need to become a Wall Street wizard, but keeping some of your assets growing is key to making sure your retirement fund doesn't shrink over time.

In summary, the Sure Horizon Retirement Income Strategy is your roadmap to a long, stress-free retirement. By balancing guaranteed income, flexible savings, and growth investments, you'll build a plan that can handle whatever life throws your way. And hey, if things get tough, don't worry-we've got the tools to help.

Conclusion: Wrapping Up Your Retirement Plan

Building a retirement plan that lasts isn’t about magic formulas or crystal balls. It’s about having a solid strategy that balances security, flexibility, and growth. Sure, there are risks along the way – from healthcare surprises to market ups and downs – but with the right plan, you can handle them like a pro.

Your retirement should be about enjoying life, not stressing over finances. And with the Sure Horizon Retirement Income Strategy, you’ve got the tools to build a future that not only lasts but thrives. From assessing your current financial situation to keeping an eye on healthcare costs, and making sure your investments are working for you, it’s all about staying prepared and flexible.

Remember, retirement is a journey, not a destination. The key is to review, adjust, and rebalance as life throws its little curveballs your way. And don’t forget – you’re not alone on this journey. Our Retirement Planning Toolkit is here to guide you every step of the way.

If you would like to learn more about this strategy, check out my latest book, The Retirement Income Equation: Proven Strategies for a Secure, Flexible, and Prosperous Retirement, available on Amazon.com.